The effect of cyclical shocks on France’s trade deficit

Informations

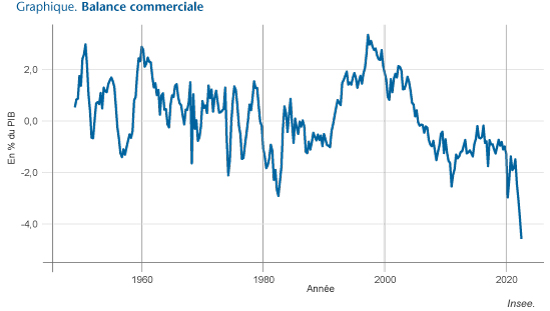

The French economy is facing a multitude of shocks with a strong impact on GDP growth prospects1. In addition to the crisis in purchasing power, these shocks have led to a deterioration in France’s trade balance, to the extent that in the third quarter of 2022 France recorded its largest trade deficit since 1949, according to the national accounts published by INSEE2: the trade balance stood at -4.6% of GDP. According to data available for the second quarter of 2022, the nation’s borrowing requirement vis-à-vis the rest of the world (a figure that takes account of income flows in particular) reached 2.9% of French value added (VA). This figure has only been exceeded twice since 1949: in the third quarter of 1982 (4.5% of VA) and following the first containment in 2020 (4.3% of VA in the second quarter of 2020; see chart).

1 OFCE Analysis and Forecasting Department, under the direction of Éric Heyer and Xavier Timbeau, 2022, ‘Du coup de chaud au coup de froid: perspectives 2022-2023 pour l’économie mondiale’, OFCE Policy brief, no. 109, 12 October.

2 It is possible to calculate the trade balance using customs or balance of payments data. Differences in scope or methodology can explain discrepancies in the published figures. National accounts offer the advantage of making comparisons over a long period using a consistent methodology.

Translated with www.DeepL.com/Translator (free version)

Before the outbreak of the Covid-19 pandemic, the trade deficit was 1% of GDP. The deterioration of more than 3 points of GDP can be explained in part by price trends. Since 2019, French imports have risen by 28%, while the export deflator has increased by 23% 3. According to INSEE forecasts, the deterioration in the terms of trade expected for 2022 should reduce the disposable income of national agents by 1.5 points of GDP in the current year4. The deterioration in the trade balance cannot be explained exclusively by unfavourable price trends. In volume terms, exports are down 3% in the third quarter of 2022 compared with an average quarter in 2019, while imports are 3 points stronger.

3 For more details on what national accounts tell us about recent price dynamics, see Amoureux, Carnot and Laurent, 2022, ‘What national accounts deflators teach us’, Insee blog.

4 See Amoureux, Carnot and Laurent, 2022, ‘Terms of trade and real domestic income: measuring the nation’s purchasing power’, Le blog de l’Insee.

The aim of this blog post is to quantify the respective contributions of changes in prices and volumes to changes in the trade deficit between 2019 and the third quarter of 2022. The contributions will be calculated at level A17 of the national accounts nomenclature. The fall in total exports mentioned masks divergent developments between branches over the period. Most branches increased their foreign sales in volume terms. The change in the overall figure largely reflects the fall in exports of products in which France had a strong specialisation: the manufacture of transport equipment (-26%) and the consumption of foreign tourists on French territory (-7%).

The following formula is used to calculate the determinants of price and volume changes in the variable (either exports or imports) for each product between 2019 and the third quarter of 2022:

\begin{equation} \Delta X_{i} = X_{i}^{2019} \;. \Delta Volume\%_{i} + X_{i}^{2019} \;. \Delta Déflateur\%_{i} \end{equation}

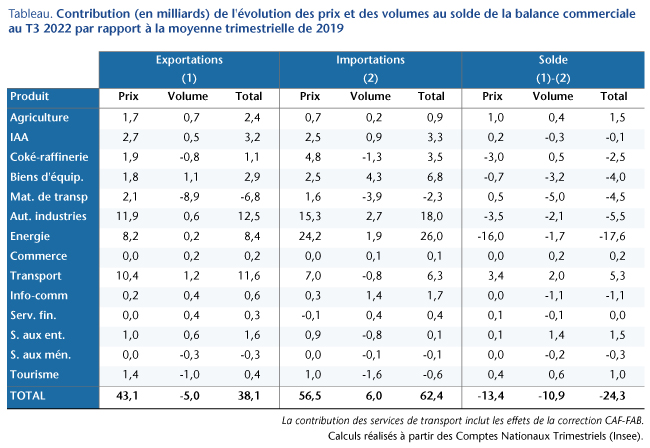

The €24.3 billion deterioration in the trade balance was mainly due to price movements (€13.4 billion) (Table). Unsurprisingly, the effect is due to higher prices for imported energy and refined products (net of exports, the effect is €19.0 billion). This dynamic is mitigated by the rise in the price of transport services (+€3.4 billion).

While the terms of trade had a negative quantitative effect, changes in volumes increased the deficit by a further €10.9 billion. Most of the fall is explained by developments in trade in transport equipment (-5.0 billion). The continuing high rate of investment explains a further deterioration in the balance due to the volumes traded in capital goods (-3.2 billion). The volume of trade in energy products also made a negative contribution to the balance (-1.7 billion), probably as a result of the rapid replenishment of gas stocks and the specific trends observed in electricity; but at this level of the nomenclature it is not possible to distinguish between these two effects. Once again, volumes traded in transport services partially offset these trends (+2.0 billion).

The contribution of international tourism deserves a specific comment. Consumption by foreigners in France is expected to be virtually stable in the third quarter of 2022 compared with 2019 (+0.4 billion). This trend masks a fall in volume (-1.0 billion), more than offset by the rise in prices. In the post-Covid context, spending by the French abroad will fall even more sharply (-0.6 billion, including a drop in volume of -1.6 billion). While tourism is an area in which France specialises and has a balance that is historically in surplus, the tourism balance still makes a positive contribution to improving the trade balance at the end of the third quarter of 2022, but this is primarily due to the notable effect of a more marked adjustment in imports than in exports.

The record trade deficit seen in the third quarter of 2022 is a warning sign for the French economy. This is largely due to the unfavourable trend in energy prices. However, for the time being, the volumes traded, far from mitigating the deficit, are actually worsening it. The situation is particularly bad for transport equipment. These shocks have been partly mitigated by the contribution of sales of transport services to the rest of the world. The greatest uncertainty for the future remains whether these shocks are temporary or permanent. This will determine the scale of the adjustment that will be needed to reduce this imbalance vis-à-vis the rest of the world, particularly if we have to finance a permanently higher energy bill.